Shubert Cineus is the visionary founder of Modern Edge Capital, a firm redefining retirement planning and wealth management with integrity-driven, personalized solutions that bring retirement dreams to life. Guided by his compelling mantra, “Don’t let fear or anxiety delay your dream retirement, or it might pass you by,” Shubert is committed to ensuring no one faces an uncertain financial future. His passion ignited after meeting countless individuals approaching retirement with just a 401(k), an IRA, and a fragile “hope plan.” Often referred to him as “well-prepared,” these clients needed far more support than expected. To address this, Shubert wrote Secrets of Becoming Tax-Efficient in Retirement and Creating Guaranteed Income for Life: Unlock the Secrets to a Wealthier, Worry-Free Retirement, available on Amazon, sharing vital strategies to empower retirees with lasting financial security.

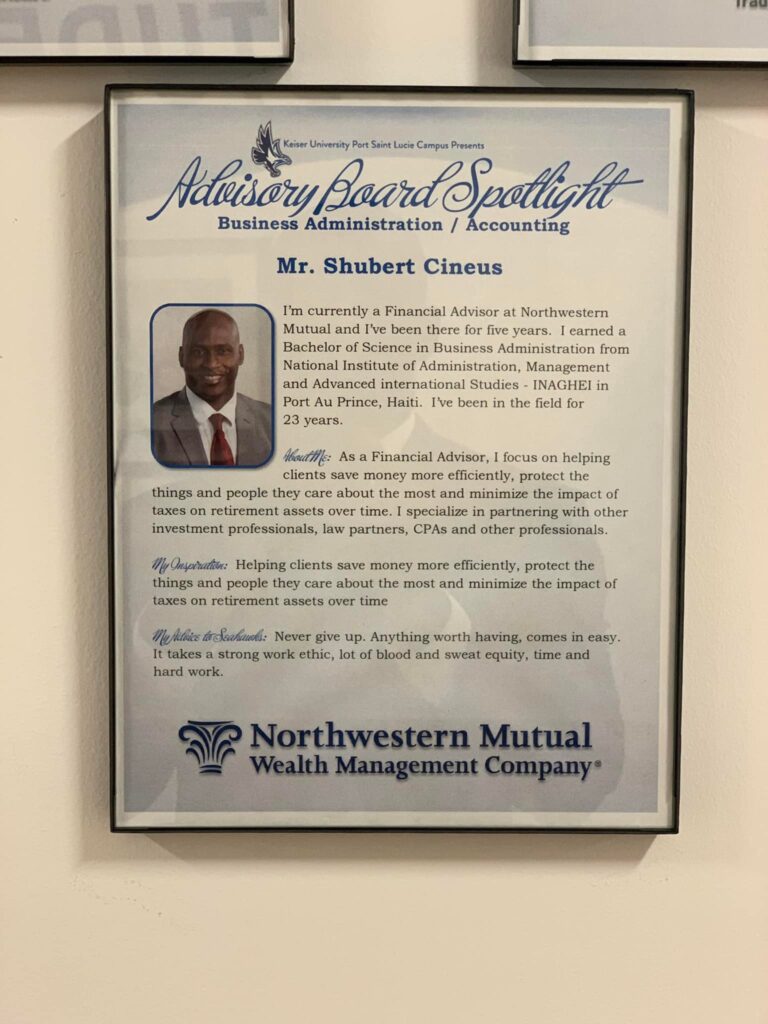

With over 7½ years as a registered agent and investment advisor representative, regulated by the U.S. Securities and Exchange Commission (SEC) and FINRA, Shubert brings a wealth of expertise to his craft. His career kicked off at Northwestern Mutual in 2017, where he spent five years honing his skills in future-focused financial planning. Seeking greater independence and a fiduciary duty to prioritize clients’ best interests, he founded Modern Edge Capital. Shubert crafts comprehensive, tailored solutions to tackle complex retirement challenges. His practice thrives on honesty and integrity, easing the anxieties many feel about outliving their savings and empowering them with strategies for a confident, comfortable retirement.

Born and raised on the Caribbean island of Hispaniola, Shubert earned a Bachelor’s degree in Business Administration from INAGHEI State University. Now a proud resident of Wellington, Florida, he lives with his two sons from a previous marriage. Beyond finance, Shubert gives back as a board member of Keiser University’s Accounting and Business Program and as an active participant in the Palm Beach Rotary Club and various nonprofit organizations. He also hosts The Smart Business Owner Podcast weekly, available on YouTube, Apple Podcasts, and major platforms, where he amplifies local entrepreneurs by providing a platform to share their stories. When he’s not shaping financial futures, Shubert enjoys unwinding outdoors, working out at the gym, golfing, or playing basketball.

As a trusted financial professional, Shubert Cineus blends experience, innovation, and a client-first ethos to redefine wealth management at Modern Edge Capital, ensuring your retirement dreams don’t just survive, they thrive.

At Modern Edge Capital, we’re here to discuss your retirement and wealth goals whenever you’re ready, helping you live life your way. With no obstacles in your path, simply tap into our open calendar and book a virtual consultation at a time that suits you best!

When you provide your contact details, you agree to be reached out to about retirement income strategies featuring a mix of investment options and insurance products tailored to your financial goals. Let Modern Edge Capital guide you toward a secure and confident retirement.

Curious about retirement planning or wealth management with Modern Edge Capital? We’ve got you covered! From how we secure your assets to what sets us apart, our answers provide clarity and confidence. Explore tailored solutions and expert insights designed to meet your financial goals—read on to discover how we can support your journey to a thriving future!

Wondering what to bring to your initial meeting? All you need are your financial questions and aspirations! Our first consultation is a relaxed conversation designed to explore your needs and outline how our retirement planning and wealth management services can help. No paperwork is necessary—just come prepared to share your vision for your financial future, and we’ll take it from there!

Yes, you can absolutely transition to Modern Edge Capital as your financial advisor, no matter where you live—Florida or beyond! We proudly serve clients across the country, offering flexible remote consultations via phone or video to fit your schedule and location. Start securing your retirement and wealth management goals with us today!

Wondering how often to revisit your financial strategy? We recommend reviewing your retirement plan and wealth goals with your Modern Edge Capital advisor at least once a year—or whenever life throws a curveball like a new job, marriage, or nearing retirement. Staying proactive keeps your plan aligned with your evolving needs and aspirations!

At Modern Edge Capital, we reject outdated, cookie-cutter strategies like the traditional 60/40 or 80/20 models—because today’s wealth management demands more. Our Wealth Managers know every client is unique, so we deliver fully customized retirement planning and financial solutions tailored to your specific short-term needs and long-term ambitions. This personalized approach ensures lasting financial security and confidence, distinguishing us from firms stuck in the past.

Modern Edge Capital is a retirement planning firm specializing in asset management for high-net-worth individuals. Committed to excellence, we strive to deliver the highest standards of service and integrity in every client relationship, ensuring your retirement planning and financial goals are met with expertise and care.

At Modern Edge Capital, safeguarding your assets is our top priority. We maintain rigorous compliance standards in alignment with SEC and FINRA regulations, including adherence to the SEC’s Customer Protection Rule (Rule 15c3-3), which is specifically designed to protect client funds and securities from misappropriation. Our firm diligently implements these regulatory standards to help ensure the integrity, security, and safety of your retirement and investment portfolios.

Investment advisory and financial planning services are offered through Simplicity Wealth, LLC, an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the firm nor does it indicate that the adviser has attained a particular level of skill or ability. Insurance, Consulting and Education services offered through Modern Edge Capital LLC. Modern Edge Capital LLC is a separate and unaffiliated entity from Simplicity Wealth.